Smarter Service, Stronger Relationships: How Rafter Helps Insurers Deepen Policyholder Trust and Risk Insight

The Missed Frontier in Insurance Innovation

Technology has transformed many aspects of the property insurance industry. Pricing is increasingly precise. Underwriting is faster and more data-informed. Claims processing is often more automated than ever before. Yet, in one critical area, little has changed: the experience of the homeowner.

For most policyholders, their insurance company is something they interact with only when something goes wrong. That interaction, unfortunately, often feels impersonal or adversarial. A problem has occurred, a claim is filed, and a process begins, one that may be unfamiliar, confusing, or frustrating for the customer.

This is more than a customer service issue. It's a missed strategic opportunity.

When the only engagement between a policyholder and their insurer happens during or after a loss, the relationship is, by design, reactive. It leaves value on the table for both parties in preventable loss, unaddressed risk, and unrealized trust.

The Reality at Home: A Complex System with Little Support

Ask a typical homeowner about managing their home and you’ll often hear some version of this:

“I had no idea how much there was to stay on top of.”

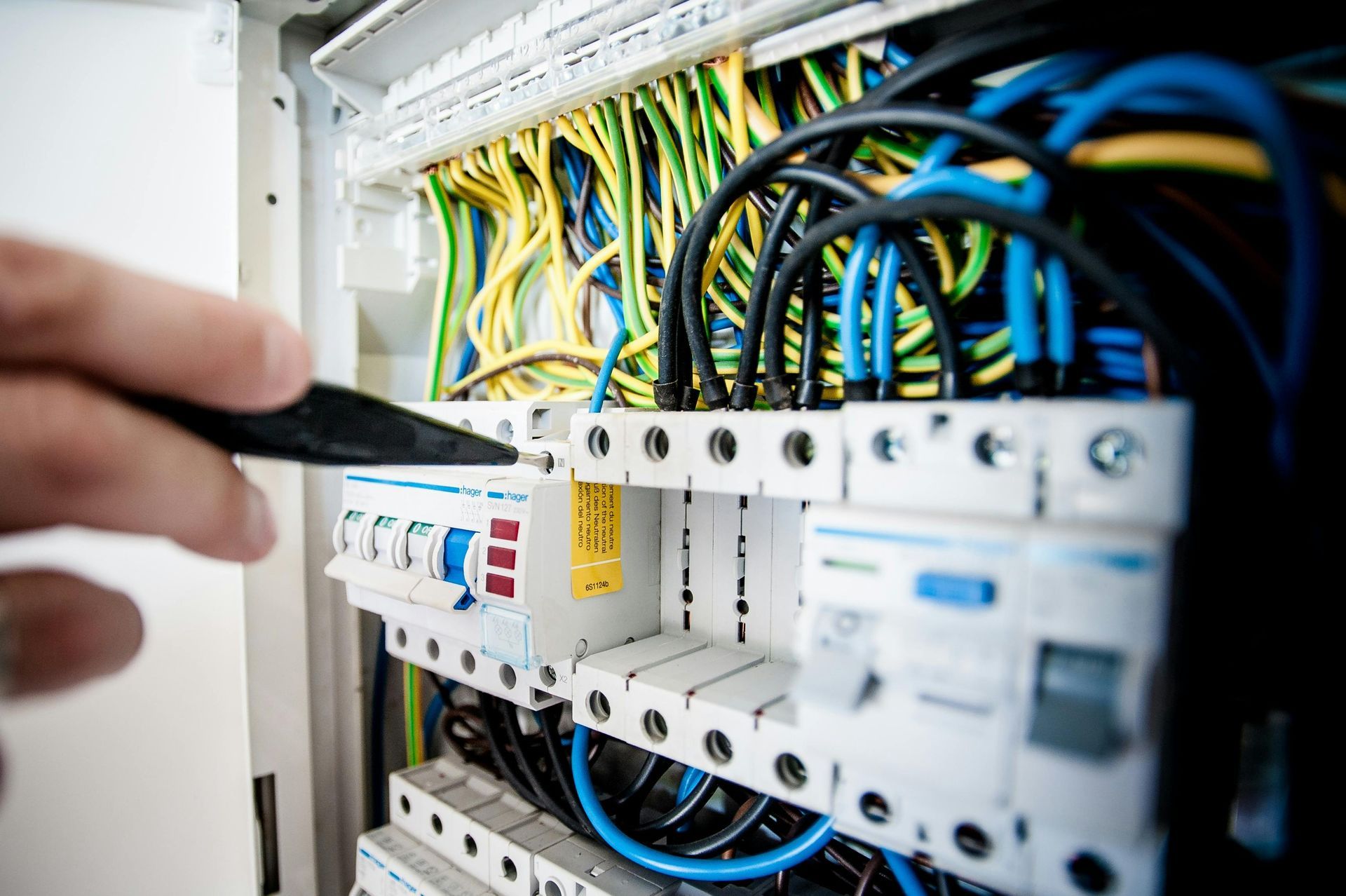

And it's true. A single-family home is a highly complex asset made up of dozens of systems and hundreds of components: plumbing, HVAC, electrical, appliances, roofing, safety equipment, and more. Each comes with its own maintenance schedule, potential failure points, and safety implications.

Most homeowners want to care for their homes responsibly. But they’re overwhelmed. They don’t have an instruction manual. And no one, not their insurer, lender, or home inspector, is providing them with a clear roadmap for what to do and when.

Why does this matter to insurers? Because that lack of clarity and support contributes directly to preventable claims.

Here are some of the structural challenges homeowners face:

- Home data is fragmented or missing. There's no shared record of what’s been maintained, replaced, or ignored. Information is often locked away in inspection reports or lost entirely. Without this foundation, proactive insight is nearly impossible.

- Everything is reactive. Maintenance often happens after something breaks, not before. Homeowners scramble to find a plumber, electrician, or roofer only once the issue has become urgent.

- No preventive infrastructure exists. While other industries (like healthcare or auto) offer standardized schedules for checkups and care, homeownership lacks a trusted system to encourage and support preventive behavior.

- Incentives are unclear or hard to access. Even when insurers offer premium discounts or incentives for risk reduction, homeowners often aren’t aware of them, or don’t know how to take advantage.

- Trust is low across the ecosystem. Whether they’re hiring contractors or navigating claims, many homeowners feel unsupported. Insurance, while essential, is still perceived by some as a safety net rather than a proactive partner.

The Consequences for Insurers

This reality at the household level adds up to significant challenges for insurers.

- Preventable losses go unaddressed. Without visibility into the real-time condition of the home, insurers often learn about risks only after they’ve turned into expensive claims.

- Engagement remains transactional. Most policyholders have few, if any, meaningful interactions with their carrier. Loyalty is thin. Retention becomes more sensitive to price and competitors.

- Innovation hits a ceiling. Even as carriers invest in AI-enhanced underwriting and smart segmentation tools, the lack of structured, current data from the home limits what those technologies can deliver.

In other words, the industry has built smarter systems. But it’s still missing a clear view of the policyholder’s biggest risk exposure: the home itself.

The Missed Opportunity: A More Connected Relationship

There is, however, a better path forward.

Insurers don’t have to be distant figures in the lives of policyholders. They can be trusted advisors, partners in risk prevention, not just responders to loss. And this shift isn’t about surveillance or oversight. It’s about service.

Helping a homeowner replace aging plumbing hoses, install functional smoke detectors, or clean a clogged dryer vent isn’t invasive. It’s empowering. It’s a way to reduce claims while building goodwill. And most importantly, it reflects the kind of alignment insurers have long sought: lowering risk while increasing satisfaction.

Homeowners want their homes to be safer, more resilient, and less stressful to manage. Helping them get there creates loyalty that’s difficult to replicate through pricing or policy design alone.

The Rafter Solution: Where Insight Meets Service

Rafter exists to help insurers activate this opportunity. We provide a preventive maintenance membership that makes homeownership easier for policyholders and risk more visible for carriers.

Through a combination of in-home services, intelligent digital tools, and expert support, Rafter enables:

- A personalized home care plan that reflects the actual systems, layout, and condition of the home

- Completion and validation of critical maintenance tasks to reduce the likelihood of common, high-cost claims

- Real-time insight into home condition and risk factors, without being intrusive or overbearing

- A better overall experience for the homeowner, regardless of whether they ever file a claim

For insurers, this translates into measurable value: lower loss ratios, higher retention, and a more modern, relationship-driven approach to policyholder engagement.

It’s not about collecting more data for the sake of it. It’s about building a bridge—between the insurer and the insured, between risk and service, between intention and action.

Let’s make insurance feel personal again. Let’s bring visibility and support into the places that matter most. Let’s help every homeowner take better care of the home they’ve worked so hard to own.

Rafter can help. Reach out to learn more.